Frequently Asked Questions

Q: What is the MG Group Fee Protection Service?

A: It is a service that provides you with protection against the cost of any HMRC enquiry against your company or you personally. Due to requirements from insurers who support the scheme, the cover taken out is separate for each entity or individual. If you are a director/shareholder of more than one Ltd company, then a separate cover will need to be taken out for each entity. If you are selected for enquiry or investigation, then MG Group’s fees in defending the claim would be fully covered.

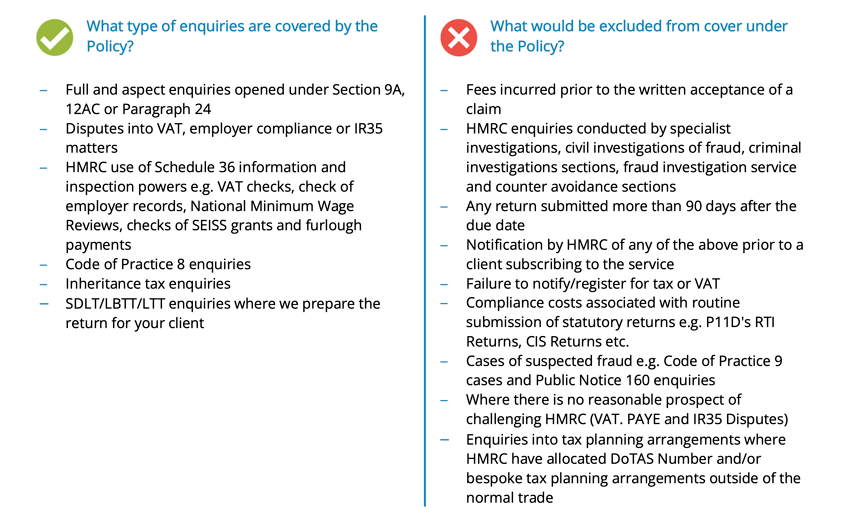

Q: What is covered by the Fee Protection policy?

A: Fee protection insurance covers the professional costs incurred in dealing with an HMRC enquiry. It protects businesses and their advisers against an increasing number of HMRC enquiries.

Q: Aren’t these costs covered by my usual fees?

A: No. MG Group only charges fees for work that is completed. For clients that pay by standing order, the fees will cover routine compliance work such as completion of accounts, tax returns, payroll etc. Our usual fees do not cover the cost of an HMRC enquiry or investigation.

Q: What would the charges be if there is an HMRC enquiry or investigation into my tax affairs?

A: For any enquiry or investigation work, we can only give an indication of the costs once we know what the nature of the enquiry. An enquiry could relate to a simple matter, in which case our time would only be around 2 or 3 hours, or it could be in relation to a number of areas and could be a complex matter that requires several hours’ worth of work. Our charge-out rates for HMRC enquiry work are: £250 + VAT per hour for a Director, £125 + VAT per hour for work completed by a manager and £96 + VAT for work completed by a Tax advisor or an Audit senior. Travel time is charged at £20 per hour.

Q: What is the probability of my being selected for investigation?

A: There is a small chance of being selected for enquiry, as the majority of clients will not have any questions asked in relation to their tax affairs. However, HMRC does routine random enquiries and if selected for this, there could be significant costs.

Q: Can we pay for the free protection by monthly instalments in the same way we pay our fees?

A: Unfortunately not as we need to make a full upfront payment to our fee protection service company.

Q: I want to find out further information before going ahead – what should I do?

A: Please get in touch with your usual MG Group contact who will explain more about the Tax Investigation Fee Protection Service that we offer.